Make the most of your HSA by understanding the tools and resources available through the HSA Member Portal.

To effectively manage your HSA, you’ll first need to create a BRIWEB account. On the BRIWEB Login page, select “Register an Account”. Follow the instructions provided, as shown in the video. You will need the following pieces of information to register:

HSAs are individual bank accounts, and as a result, are subject to identity verification procedures. If your identity cannot be verified through our identity verification system, BRI will reach out and request: (1) a copy of your state-issued driver’s license, state-issued ID, or passport, and (2) a copy of your Social Security card. For your convenience and security, we provide several secure options for submitting this information online or by mail. If this information is not provided within 45 days, the account is closed and any deposits received prior to account creation will be returned to the originator.

The video to the right highlights key management features of the HSA Member Portal, including:

Continue reading to get detailed instructions on the features listed above, or download our HSA Experience flyer using the button below.

Once logged in, select the “Health Savings Account” tab from the left sidebar. There, you’ll see:

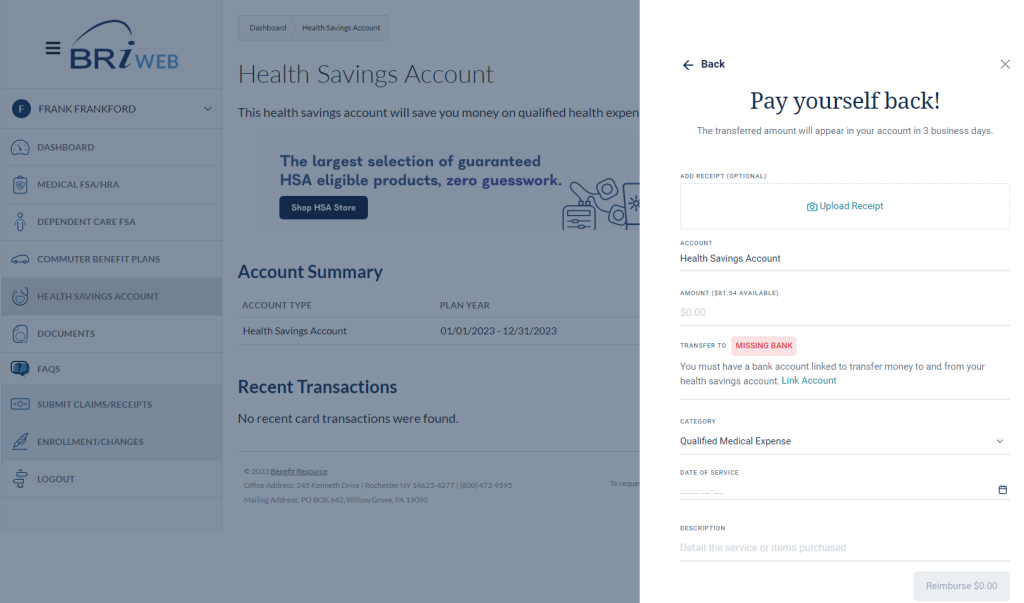

If you pay for an HSA-eligible expense with a source of payment other than your Beniversal Card, you can reimburse yourself with HSA funds.

If you overfunded your account by contributing more than the IRS annual contribution limit, you can withdraw funds to avoid IRS tax penalties.

Note: Any HSA corrections, including disbursements to correct excess contributions, must be completed by the tax filing deadline of April 15th following the tax year. This deadline is not affected by any submission to extend the tax filing deadline. Learn more

If you’ve used HSA funds for unqualified items or services, you may be subject to an audit by the IRS and required to redeposit the amount spent. Here’s what you need to do to correct it.

Click the arrow next to “Health Savings Account” on the HSA Member Portal “Wallet” page (homepage/dashboard). Then, click the eye icon to view your account number. You’ll also find it within your monthly statements.

Account statements will be available on a monthly basis. To access them, click on the “Health Savings Account” tab. From the “I want to…” dropdown menu on the right-hand side of the page, click “Manage my HSA” to be redirected to the HSA Member Portal. Once there, select “Profile” from the left menu. From the sub-menu, select “Statements.” All statements are available as a PDF for download by clicking the “View” button to the right of the item you are interested in accessing.

HSA tax documents are generated based on the type of activity you have in your account in a given year. Access your documents by clicking on the “Health Savings Account” tab. From the “I want to…” dropdown menu on the right-hand side of the page, click “Manage my HSA” to be redirected to the HSA Member Portal.

Once there, select “Profile” from the left menu. From the sub-menu, select “Tax Forms.” All tax forms are available as a PDF for download by clicking the “View” button to the right of the item you are interested in accessing. Tax documents you might find there include:

Tax reporting note: If you do not have any deposits or withdrawals in your account in a given tax year, you will not receive any tax documents. In addition to your tax forms, any pre-tax contributions made through your employer will be reported on the W-2 from your employer.

Like many retirement-based accounts, HSAs allow the owner of the account to set up a beneficiary who would receive the HSA funds upon their death. To set a beneficiary for your account funds, click on the “Health Savings Account” tab. From the “I want to…” dropdown menu on the right-hand side of the page, click “Manage my HSA” to be redirected to the HSA Member Portal.

Once there, select “Profile” from the left menu. From the sub-menu, select “Beneficiaries”. Then just select the “Add Beneficiary” button and complete the information requested.

If you are looking to move HSA funds from a prior HSA to your BRI/Inspira HSA, you can complete either an “HSA Transfer” or an “HSA Rollover.” The rules and limitations for each are specific, so it is important to understand the differences between these options in order to decide which path works for you. Download our Transfer vs. Rollover Comparison Flyer to learn more about which may be right for you depending on your situation.

TO REQUEST AN HSA TRANSFER (FORMALLY KNOWN AS AN HSA TRUSTEE-TO-TRUSTEE TRANSFER):

TO REQUEST AN HSA ROLLOVER:

If an HSA rollover is marked as a “New Contribution,” it will count toward your annual HSA contribution limit. To prevent overfunding penalties (exceeding the IRS annual limit), make sure to update the transaction.

Tax Reporting Note: The updated information will appear on the final forms issued at the beginning of April. If no corrections are needed, you can file your taxes at any time.

Get an overview of how to invest your HSA in the next section.

Investments are: Not FDIC Insured • May Lose Value • Not Bank Guaranteed

After opening an investment account in the HSA Member Portal, you can begin to invest* your HSA funds in 1000+ top-rated stocks, mutual funds, and ETFs specifically curated for you by Morningstar Investment Management.

Note that inclusion of Investments on this list does not guarantee continued availability for trading. Investments available for trading are subject to change periodically. For real-time information and availability regarding investments, please log into your account at BRIWEB.

Invest for as little as $1 per month upon account creation. After an investment balance of $5,000 is reached, accounts will be charged an investment balance fee of 0.01% monthly.

It may take 2-3 days for proceeds to return to your HSA cash account. Investments are not available for debit card purchases and online transfers.

*Investments are: Not FDIC Insured • May Lose Value • Not Bank Guaranteed

HSA investing is self-directed. BRI is not a registered advisor and cannot provide advice regarding specific investment selections – please consult a registered investment advisor for recommendations and investment advice. However, here are some ways to search for potential investments.

To purchase a stock, simply enter the name or stock symbol in the search bar. A summary of the stock is presented, including market stats. You will be able to invest in most stocks available through the New York Stock Exchange. Certain stocks may not be available. View the directory of stocks available on the New York Stock Exchange.

Common search terms you may want to use if you know the types of investments you would like to consider:

1. Please note that the terms and conditions governing the HSA Investment Account, including the timing of trades, are contained in the Investment Agreement.

2. HSAs are administered by Benefit Resource, LLC, an Inspira Solution, and custodied by Inspira Financial Health, Inc. Benefit Resource, LLC is an affiliate of Inspira Financial Health, Inc. and Inspira Financial Trust LLC. Benefit Resource, LLC and its affiliates do not provide legal, tax or financial advice. Please contact a professional for advice on eligibility, tax treatment and other restrictions. Investment services are independently offered through an independent, third-party registered investment advisor, Morningstar, Inc., and powered by DriveWealth brokerage technology in collaboration with First Dollar. The HSA investment account is an optional, self-directed service, and neither Benefit Resource, LLC nor any of its affiliates provide investment advice. By transferring funds into an HSA investment account, you will be exposed to a number of risks, including the loss of principal, and such funds are not FDIC or NCUA insured, or guaranteed by Benefit Resource nor any of its affiliates. You should always read the prospectus for the funds you intend on purchasing. The prospectus describes the funds, investment objectives and strategies, their fees and expenses, and the risks inherent to investing in each fund. Investing through the Benefit Resource platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and the Investment Agreement. System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors.

Manage all your pre-tax benefit accounts with BRI online through BRIWEB or on-the-go with the BRIMOBILE app. Click the buttons below to learn more.

MAILING ADDRESS:

PO Box 642

Willow Grove, PA 19090

EMPLOYEES: (800) 473-9595

EMPLOYERS: (866) 996-5200

Benefit Resource and BRI are tradenames of Benefit Resource, LLC. Benefit Resource, LLC is an affiliate of Inspira Financial Health, Inc. and Inspira Financial Trust, LLC. Benefit Resource, LLC does not provide legal, tax or financial advice. Please contact a professional for advice on eligibility, tax treatment and other restrictions. Inspira and Inspira Financial are trademarks of Inspira Financial Trust, LLC.

The Beniversal and eTRAC Prepaid Mastercards are issued by The Bancorp Bank, N.A., Member FDIC, pursuant to a license by Mastercard International Incorporated and may be used for eligible expenses everywhere Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

HSA Custodial Services are provided by a separate financial institution. See your HSA Account Agreement for specific account terms.

©2025 Benefit Resource, LLC | All Rights Reserved

Privacy Policy|Terms of Use|Accessibility|Website developed by Mason Digital

We would love to chat with you about your current benefits offerings and best practices that may save you and your employees even more.

Submit Your RFP NowSearch through our interactive database of videos, flyers, tutorials, and other tools to help maximize your BRI experience.

View All ResourcesBRI combines expertise and excellence to provide premier ongoing support to employers and participants, backed by experts and technology you can trust.

BRI is consistently listed in the Rochester Top 100 Companies! We offer growth opportunities and competitive benefits. Join a great place to work!

© 2025 BRI | Benefit Resource