What happens to any amount left in my HRA that I do not use by the end of the plan year?

Refer to your Plan Highlights regarding the funds remaining in your HRA at the end of a plan year.

Are expenses for services provided prior to my effective date in the HRA eligible for reimbursement?

No. Services must be provided on or after your effective date in the plan, as indicated in your Plan Highlights.

How will I receive reimbursement of eligible services?

After receiving and reviewing your claim, Benefit Resource will issue a reimbursement for your eligible expenses. There are three options for receiving your reimbursement: If you elect Direct Deposit reimbursement, funds will be deposited directly into your bank account and a Direct Deposit advice will be sent notifying you this has been done. If you […]

What expenses are eligible for reimbursement under my HRA?

You can use your HRA for the reimbursement of certain eligible medical expenses not covered or reimbursed by any other source, whether provided to you or your dependent(s). Your Plan Highlights specify the types of expenses that are eligible for reimbursement from your HRA. Services provided for cosmetic reasons and those that are merely beneficial […]

How can I determine my HRA balance?

Your account balance will be displayed on the Explanation of Benefits (EOB) issued with each reimbursement check/Direct Deposit advice. Account information can be accessed 24/7 when you log into BRiWeb or the BRiMobile app. USE THE QUICKBALANCE FEATURE: Get your balance over the phone in under a minute 24/7 through our automated QuickBalance Line. STEP 1: […]

How do I know how much is contributed to my HRA each plan year?

At the beginning of each plan year, your employer will notify you of the amount they will contribute to your HRA for that plan year.

How do I enroll in the HRA?

On the date you become eligible to participate, you will be automatically enrolled in the HRA. You will continue to participate in the HRA until you become ineligible (e.g. no longer meet the eligibility requirements, terminate employment or retire).

Who is eligible to participate in an HRA?

Eligibility requirements for an HRA are indicated in your Plan Highlights.

What happens to the previous plan year funds that I do not use during the extended grace period time frame?

Any funds remaining in your account after the end of the extended grace period are forfeited.

What is an extended grace period? (HRA)

IRS Notice 2005-42 modifies the Use-or-Lose Rule to allow participants to access any unused amounts in a Health Reimbursement Account (HRA) at the end of the plan year to reimburse eligible expenses provided during a grace period after the close of the plan year. Note: The IRS does not require plans to include the extended […]

Where should I submit my claim first for medical expenses: to my insurance or my HRA?

Your claim must always be submitted to your insurance carrier first. The remaining eligible expenses that you pay out-of-pocket can then be submitted for reimbursement from your HRA.

What OTC items are not eligible for reimbursement?

OTC items are not eligible for reimbursement if they are normally used for general health, are not used to treat a medical condition (e.g. toothpaste, mouthwash, lotion, shampoo) or are cosmetic in nature (e.g. teeth whitening products, wrinkle reducers). See additional examples in the OTC Chart.

What documentation do I need to submit for reimbursement of eligible OTC items?

Along with your completed claim form, you must submit an itemized receipt that includes the following information: Name of the provider Date of the purchase Name of the item being purchased Your out-of-pocket cost for the service Your signature on the claim form certifies that the item qualifies as an eligible expense under IRS regulations, […]

What requirements must be met for an OTC item to be eligible for reimbursement?

To be eligible for reimbursement: A medical item must be used “primarily for the prevention or alleviation of a physical or mental defect or illness.” It cannot be used unless it is for a particular medical condition. A drug or medicine requires a prescription from your medical provider. The item must be used by the […]

Can I purchase large quantities of OTC items?

Reasonable quantities of eligible OTC items are reimbursable if purchased for either existing or imminent medical conditions. If large quantities are necessary for the treatment of an existing condition, the medical provider must indicate on the Certification of Medical Necessity form that the quantity being purchased is necessary for the treatment of a diagnosed medical […]

I am a participant in the plan for this current plan year, but will not re-enroll in the plan for the next plan year. Does the extended grace period rule apply to me at the end of this current plan year?

Yes. As long as you are a participant in the plan through the end of the plan year and have funds remaining at the end of the plan year, you may submit claims for eligible services provided during the extended grace period.

If I terminate employment during the plan year, does the extended grace period apply to me?

No. You must be a participant in the plan on the last day of the current plan year to take advantage of the extended grace period. Note: the exception to this rule is when COBRA (if offered by your employer) is elected for the account.

What is the length of the extended grace period?

If your plan includes the extended grace period, it is for 2-1/2 months after the end of the current plan year. You should refer to your Plan Highlights for the time frames that are applicable to your plan.

How does reimbursement for orthodontia expenses work?

For a plan that allows reimbursement of orthodontia (e.g. Medical FSA), IRS regulations allow reimbursement based on date of payment, date of service or the payment due date on statements/coupons. IRS regulations allow a Medical Flexible Spending Account (FSA) participant to be reimbursed for pre-paid orthodontia services, up to a participant’s annual election amount, before […]

Can I submit a claim for a medical service before the service is provided if I have already paid for it?

No, you need to wait until after a medical service has been provided before submitting your claim. (Note the IRS exception on “How does reimbursement for orthodontia expenses work?”)

Can I submit a claim for a medical service prior to paying for it?

As long as the service was provided, a claim can be submitted for reimbursement whether or not payment has been made.

Must all my claims be submitted before the plan year ends?

No. Claims for eligible services must be received by Benefit Resource within the time frame indicated in your Plan Highlights.

How do I submit an expense for reimbursement?

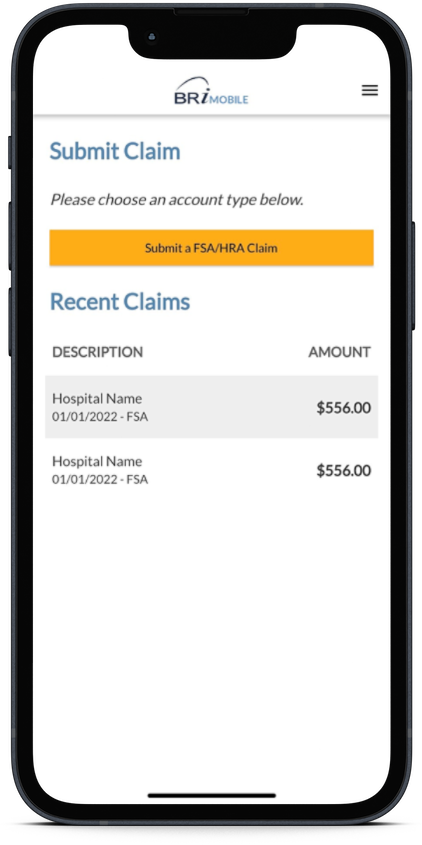

After a service is provided, you will need to submit a completed claim with supporting documentation to Benefit Resource. You can do this in one of the following ways: The BRIMOBILE app allows mobile device users to submit claims on-the-go. Log into the participant website, under the FSA/HRA Plans tab, select Submit an Online Claim. Complete […]

Is there a minimum claim submission amount?

There is no minimum claim amount, but your Plan may have a minimum reimbursement amount (usually $15). If your eligible claim amount is less than the minimum, it will be held until additional claims are submitted. (During the run-out period after the end of each plan year, reimbursements will be issued even if they are […]