Identity theft is a growing trend, with the 2019 NortonLifeLock Cyber Safety Insights Report confirming that close to 46 million consumers* fell victim to identity theft.

To successfully avoid identity theft within your benefits program, implement a comprehensive cybersecurity approach covering these three areas.

Nearly one out of two people were (44%) affected by identity theft in 2017.

1. Prevent exposure of sensitive data.

Preventing identity theft is not always possible. But, there are certain precautions that employers and participants can take to minimize risk.

Always transmit sensitive data securely.

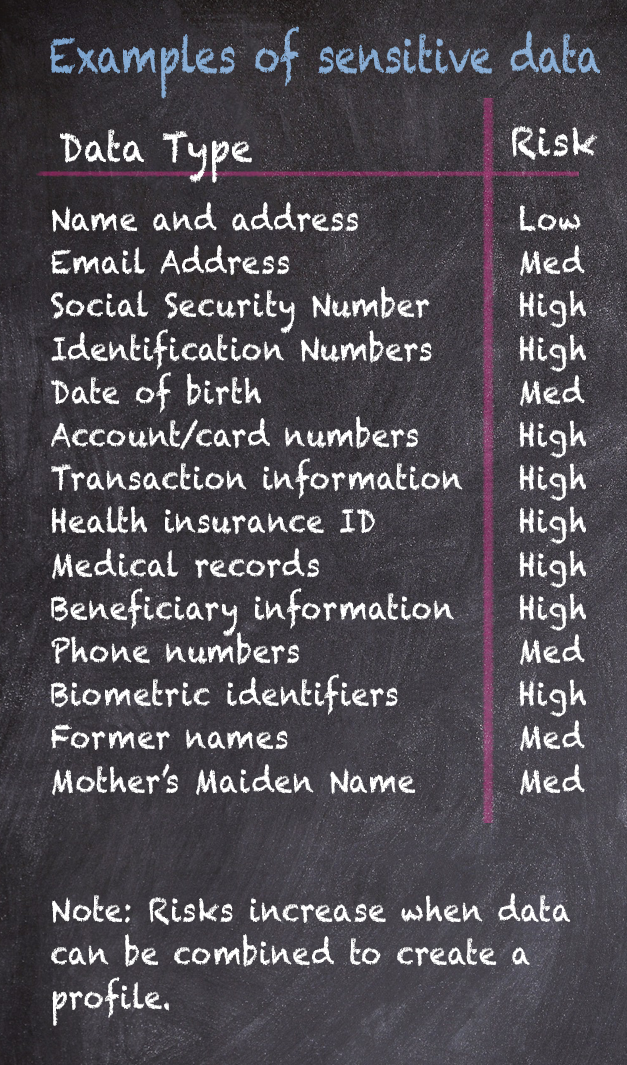

The most common classifications of data are Personally Identifiable Information (PII) and Personal Health Information (PHI).

PII includes items such as: social security number, date of birth, account numbers or other unique identifiers. PHI means any individually identifying health information.

PHI may include: medical IDs, insurance IDs, health records and health transactions. Avoid sending this information by email as it is not secure and increases the risk of identity theft. If you are asked to provide sensitive information by Benefit Resource, BRiWeb offers secure upload options for transmitting information.

Limit the exchange of sensitive information.

As a best practice, never send more information than necessary/requested. When you limit who has your data, you control potential access points to it.

Ensure sensitive data is encrypted.

Sensitive data, such as social security numbers, should be encrypted both in transmission and at rest. Then, if a database breach were to occur, the encryption prevents hackers from accessing the sensitive data.

Make sure sensitive information is not saved in unsecure locations.

Information saved in emails, attachments, personal devices or electronic storage devices is at a greater risk for theft and data breach. Ensure all sensitive information is housed securely.

Validate the domain whenever asked to login or supply personal information.

When accessing websites, take the extra step to verify the domain. The domain is always the portion of the URL directly proceeding the extension (such as .com).

Benefit Resource uses two secure domains — benefitresource.com and briweb.com. You can confirm you are using the secure URL by looking for “https://” at the beginning, instead of “http://”.

Note: Benefit Resource often includes links in emails for your convenience. These links typically include tracking URLs, which vary from these domains. You are encouraged to take extra precaution to review the domain before entering personal information. If you ever question the validity of a link, you can always access the site directly or contact us.

Overall, a solid approach to prevention can go a long way to limiting risk of exposure.

2. Monitoring for data breach and fraud.

The second component to an identity theft strategy is monitoring. There are several forms this can take. Benefit Resource has procedures, algorithms and monitoring systems in place to identify potential data breaches (which is a leading cause of identity theft) and fraud risk. For example, if fraud is suspected with a Beniversal Prepaid Mastercard, the card would be marked as lost/stolen to stop any future exposure. After that, the affected participant would be contacted to verify the transactions, and if appropriate, a new card would be issued.

In addition, participants can monitor their identity by signing-up for Beniversal Identity Theft Services. Beniversal IT Theft Services are offered to all cardholders at no charge through our partnership with Mastercard. Monitoring services extend beyond the Beniversal Card and can include monitoring of social security numbers, bank accounts, other debit/credit card, email addresses, and health account IDs. All participants need to do is register with the first six-digits of their Beniversal Card. Then they determine what they want to monitor. If their information is ever found on the “dark web”, they will receive an alert, including suggested actions to take.

Sign-up for FREE Beniversal identity theft services

NOTE: Upon clicking the “SIGN-UP” button above, you will be directed to a site hosted by Mastercard International.

3. Replace & Repair

Unfortunately, identity theft is often unavoidable. Victims of identity theft spend an average of 19.8 hours dealing with the aftermath1. Going it alone is likely to be overwhelming and take even more time. Having someone in your corner to guide you through the process and help you navigate it is key.

When you register for Beniversal identity theft Services, you also receive comprehensive support to replace and repair your identity. Experts guide individuals through the process of notifying the major credit reporting agencies, cancelling and replacing cards, and assisting with paperwork to alert various parties of potential fraud.

Confidence for the Future

Have confidence for the future by taking steps to prevent exposure of sensitive data and actively monitoring against breaches. Even if identity theft occurs, you’ll have the support you need to replace and repair your identity.