What happens when a qualifying COBRA event occurs?

An employee terms and you notify your COBRA administrator of the qualifying event. A letter goes out and you are done, right? Well, yes and

Sharing Information & Opinions on Tax-Free Health & Commuter Benefits

An employee terms and you notify your COBRA administrator of the qualifying event. A letter goes out and you are done, right? Well, yes and

BRI is offering a new Health Account Outlook Series, which will tackle a variety of topics affecting health accounts, including generational and behavior trends, consumer attitudes, how legislation

Mental health is an important component of overall workplace wellness. Employees with access to mental health resources and a better understanding of their mental health

What employers should consider Finding the right Commuter Benefit Plan (CBP) doesn’t have to be difficult. There are steps you can take to narrow down

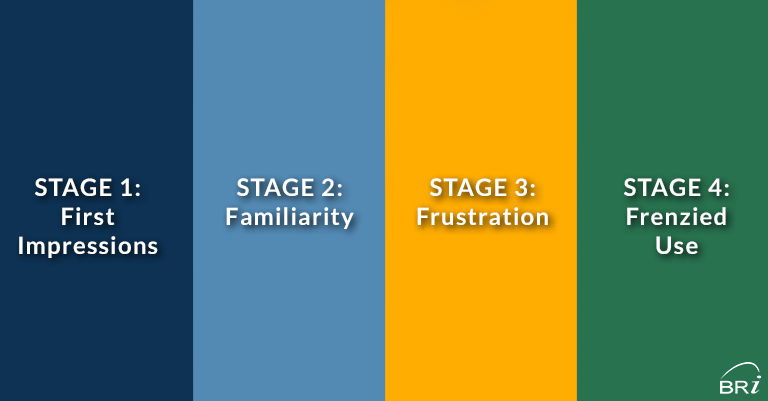

BRI is offering a new Health Account Outlook Series which will run through April. In this series we will tackle a variety of topics affecting

In the wake of the pandemic, many companies were forced to transition to a remote work model. With the pandemic seemingly coming to an end,

When it comes to managing the health and well-being of employees, employers must understand what’s best for both their organization and individuals. That includes being

Health Savings Accounts (HSAs) are tax-advantaged accounts that allow you to pay for medical expenses now and in the future. Whether you already have an

In these ever-changing times, commuter benefits are becoming increasingly important. Comprehensive commuter benefit programs provide employees with flexible transportation choices and employers with a visible

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are both incredibly valuable benefits to help employees use pre-tax dollars to pay for eligible medical

Join us for Part 2 of our new Health Account Outlook Webinar Series ‘‘HSAs Are Not One Size Fits All” on Tuesday, March 7th at 1:00 PM ET. The

Offering pre-tax benefits is the first step in helping employees lower out-of-pocket expenses, but employers should also make sure to explain the associated financial benefits.

Join Benefit Resource (BRI) for our webinar ‘Leverage Employee Insights for a Strategic Approach to Health Accounts‘ on Tuesday, February 14th at 1:00 PM EDT. BRI is offering

Health Savings Accounts have many advantages, but there is still an air of misunderstanding around some of the main tenets of the account. One such

If you’re looking for the ultimate retirement savings combo, look no further than a 401(k) plan and a Health Savings Account (HSA). Combining these two

In the modern workplace, it’s essential to create a team culture that is both engaging and inspiring. But how do you achieve this when you

The dreaded lost receipt. We’ve all been there. We’re trying to save money and use our FSA or HSA accounts, so we tuck away that

Employee engagement has become a more significant priority for employers in recent years. The generational gap between baby boomers and millennials or gen z can

If you enrolled in a Flexible Spending Account (FSA) this year, you made a good choice. An FSA (which often comes with an FSA card)

The 2023 spending bill signed into law on December 29th includes extending pre-deductible telehealth services coverage. This is excellent news for employers and HR professionals

It’s that time of year again! The new year is upon us, and with it comes hopes of achieving our goals for the upcoming months.

Pre-tax benefits are growing in popularity amongst employers and employees alike. This is because they offer a great way to save on taxes while still

The arrival of December often triggers the onset of a mild panic attack for many individuals. We’re not referring to the anxiety that tends to

Health savings accounts (HSAs) allow employees to save and build wealth for future medical costs. HSAs are an incredibly advantageous tool for employers and employees

245 Kenneth Drive

Rochester NY 14623-4277

EMPLOYEES: (800) 473-9595

EMPLOYERS: (866) 996-5200

Benefit Resource and BRI are tradenames of Benefit Resource, LLC. Benefit Resource, LLC is an affiliate of Inspira Financial Health, Inc. and Inspira Financial Trust, LLC. Benefit Resource, LLC does not provide legal, tax or financial advice. Please contact a professional for advice on eligibility, tax treatment and other restrictions. Inspira and Inspira Financial are trademarks of Inspira Financial Trust, LLC.

The Beniversal and eTRAC Prepaid Mastercards are issued by The Bancorp Bank, N.A., Member FDIC, pursuant to a license by Mastercard International Incorporated and may be used for eligible expenses everywhere Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

HSA Custodial Services are provided by a separate financial institution. See your HSA Account Agreement for specific account terms.

©2024 BRI | Benefit Resource All Rights Reserved.

Privacy Policy|Terms of Use|Accessibility|Website developed by Mason Digital

We would love to chat with you about your current benefits offerings and best practices that may save you and your employees even more.

Submit Your RFP NowSearch through our interactive database of videos, flyers, tutorials, and other tools to help maximize your BRI experience.

View All ResourcesBRI combines expertise and excellence to provide premier ongoing support to employers and participants, backed by experts and technology you can trust.

BRI is consistently listed in the Rochester Top 100 Companies! We offer growth opportunities and competitive benefits. Join a great place to work!

© 2024 BRI | Benefit Resource