The word “integration” has been getting a lot of attention in health benefits and pre-tax benefit accounts. There are many different varieties of integration and considerations. The first thought might be… “It’s integrated. It must be better.” But before making a final call on integration, it might be best to dig a little deeper and get a complete picture.

In this post we will seek to describe the ins and outs of integration, along with several considerations from both sides.

Integration: What is it?

Integration: What is it?

At the basic level, integration is simply an exchange of data from one system to another. When you apply this idea to pre-tax benefits, it is typically the exchange of enrollment information, additions or terminations of benefits, election deduction information and possibly claims information. It may also involve single sign-on from one portal to another or the display of key data points, such as balance and recent transactions, in a centralized system.

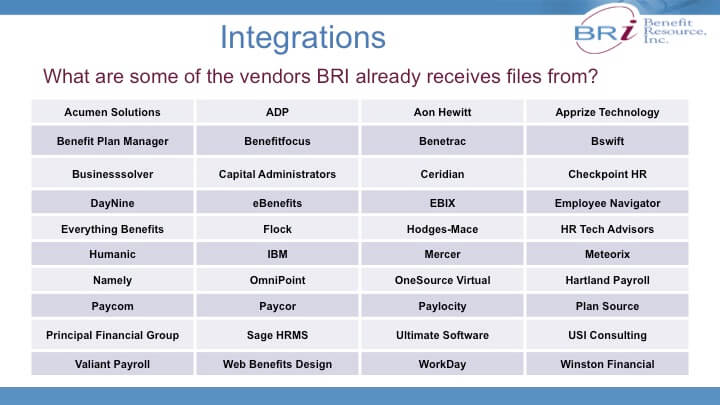

Benefit Resource is no stranger to integration. We work with many benefits enrollments systems, payroll systems and health plan carriers to exchange data. Benefit Resource is able to work with any vendor but here is a sample list of integrations:

What is the advantage of integration?

When data is integrated, the flow of information from one system to another provides a seamless approach to administration. For example, updates or changes are made in the benefits administration platform or payroll system and automatically flow to the pre-tax benefit account. This saves time, eliminates manual processes and likely results in more (and faster) processing.

So, what’s the catch? Why wouldn’t everyone integrate?

There are a wide variety of reasons (or considerations) regarding integrations.

1) It can be costly.

Integration often involves multiple players. Many of them are likely to have an initial set-up charge or ongoing file management fee. These fees can sometimes outweigh the incremental efficiency gains.

2) Oversharing of data

Some vendors have difficulty (or simply don’t want to spend the time) filtering information to the required data points. Instead, they will share all data with all parties. In the electronic age we live in and with identity theft at an all time high, it may make sense to control who has access to employee’s very personal and private information. Each party that has access to information introduces additional security risks.

3) Locks or limits your ability to choose.

When you choose an integrated option, you might be tying your benefits decisions to one vendor. If for example, you choose a specific health carrier, they may say “we have ABC for pre-tax accounts and will automatically send enrollments to ABC”.

At start-up this might seem like the easy, simple decision. But, down the road it may present a challenge. How does ABC approach customer support? What happens to your accounts with ABC when you want to change carriers? What once seemed like the “easy” route can quickly tie you down.

If you want the freedom to change carrier relationships, choosing an independent pre-tax benefit account administrator may be the longer-term win.

4) Not all benefits are equal

Benefits enrollment systems are typically designed with an open enrollment period and annual election in mind. When managing a monthly benefit, such as commuter benefits, you may find a direct solution with the third party vendor is actually easier and more effective in managing the benefit.

What leads to a successful integration? (AKA: Pitfalls you should avoid)

What leads to a successful integration? (AKA: Pitfalls you should avoid)

When you are looking to use two (or more) integrated partners for your overall benefits package, it will typically involve some set-up and testing. There are a few things to understand for a seamless integration:

1) The information available

Each vendor has a defined set of data. A payroll vendor, for example, may not have detailed benefits enrollment details. They may only have payroll deduction details. By contrast, the benefits administration platform may house annual election information but not reconcile with per payroll deductions.

2) The common link

In order for systems to effectively exchange data, they must have a common link. This is typically a unique identifier such as a social security number, member ID or payroll ID which is the same between all systems.

3) Alignment of data flow and processes

Integrations are most effective when the flow of data aligns with the selected processes. For example, if you plan to pass payroll information to the pre-tax account administrator, it makes sense to also fund pre-tax accounts based on the payroll schedule. If you decide to fund on a monthly basis when payroll is taken bi-weekly, it could impact the ability to effectively use and reconcile the data between the systems.

There can also be plan design limitations that lead to bumps in the road. Benefit Resource offers many types of configurations and options to help circumvent those bumps and achieve a seamless alignment.

4) Be a champion for your data

Employers are in a unique position to “politely demand” that their information is shared with a third-party, such as Benefit Resource. While Benefit Resource is prepared to lead the process to integrate your information, you ultimately have the relationship with the benefits enrollment system, payroll provider or carrier. It is that relationship that will ensure the vendor actively configures the file integration and testing in a timely manner.

5) Start early

If you are interested in getting integrated, it is always good to start early. The time to integrate varies widely. It may take as little as a week with a test file, but can take months when a vendor is busy (or unmotivated). As year-end approaches, integration resources can be limited. Be ready. Start early.

As you pursue your integration exploration, it might be discouraging at times. Don’t be afraid to own it and it will pay off. So if you are ready to ‘get integrated,’ contact us.

Integration: What is it?

Integration: What is it? What leads to a successful integration? (AKA: Pitfalls you should avoid)

What leads to a successful integration? (AKA: Pitfalls you should avoid)