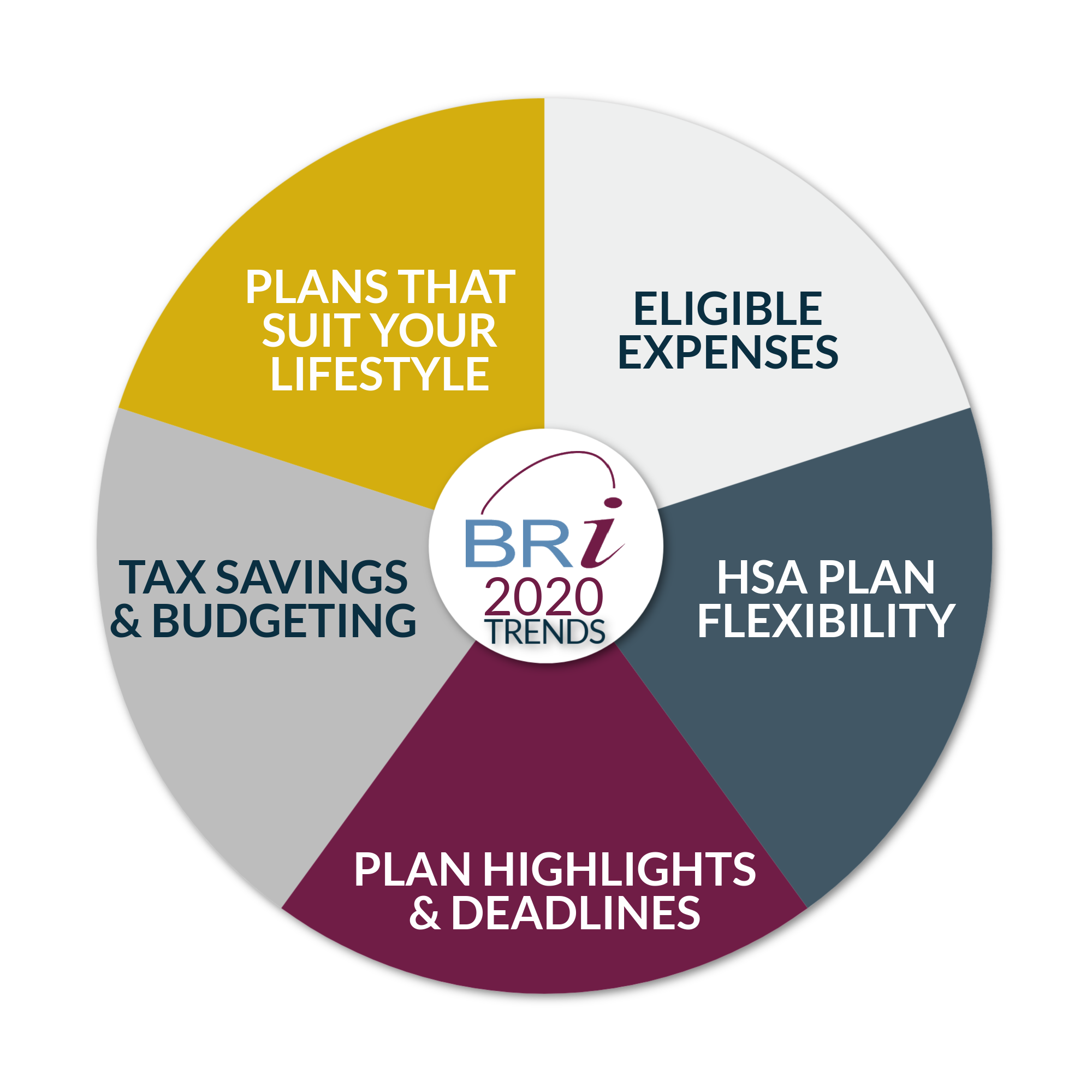

We wanted to share the main lessons BRI employees learned about financial wellness in 2020.

Financial Wellness Lessons

Kimberly Patterson (Client Services)

Having a plan for retirement is a huge part of financial wellness. A large part of preparedness for that season is HSAs. They roll over from year to year, and funds can accumulate for expenses incurred during retirement!

Ashley Hurrell (Marketing)

During these crazy times, life can be stressful. Telehealth appointments may be covered by your health plan and tax-free benefit plans could supplement the cost.

Robin Winter (Growth Team)

Health Savings Accounts (HSAs) are most appealing to an individual or family that has relatively modest medical care expenses, can afford a high-deductible medical plan and could take advantage of the substantial tax benefits of an HSA.

Melissa Trouerbach (Data Maintenance) & Sharon Ritchart (Operations)

BRI plans are EASY to use. The convenience of having these funds taken from payroll and be available when needed are key!

Sarah Mercik (COBRA)

Find yourself out of work? If you have an HSA, you can use that account to pay for expensive COBRA premiums.

Becky Seefeldt (Strategy)

2020 has proven why HSA’s are so important. Can’t get to a dentist? No worries. You’ve always got next year. HSAs roll-over year and the funds are always yours (even if you find yourself in a situation where you can’t stay with your employer). HSAs belong to the account holder and are kept by the employee even when changing jobs.

Casey Burke (Marketing)

With everything going on (especially this year), it’s hard to plan sometimes. Not all health care expenses count as “qualified medical expenses” according to the IRS. Find out which ones apply to your plan.

Anonymous

Not to get all personal…but the COVID-19 baby boom could be a real thing, and some couples in self-quarantine may find themselves requiring a pregnancy test. Don’t worry, pregnancy tests are covered and considered a reimbursable medical expense.

Giovanna Donato-Reyes (Growth Team)

I can stretch my money further by putting my tax savings to work. When I can use $7 of my own money and get $10 to spend on out of pocket medical expenses, that’s a great deal! Putting money aside into my HSA gives me some peace of mind in this year of uncertainty.

Dave Stehler (Participant Services)

Look at your Plan Highlights and really understand your deadlines. This is extremely important in making sure you are using the benefits correctly and on time.

Jonna Reczek (Marketing)

Keep your receipts for unreimbursed medical expenses. You can use them to get tax-free funds from your account.

For other great tips, check out Top 5 Questions of a Newly Enrolled Benefits Participant and 5 things you need to understand about new benefits.