George Bernard Shaw said, “The single biggest problem in communication is the illusion that it has taken place.” It begs the question: How do you make sure communication has taken place? Communication— especially improving internal communications in the workplace— is easier said than done. While employee communication doesn’t have a season, there are several employee communication best practices for Open Enrollment. For starters, there are multiple effective internal communication tools to consider. Secondly, you’re going to be faced with people who like to receive employee benefits from company communications in a variety of ways.

Defining Communication

Let’s start by defining what “communication” isn’t:

Communication is not:

|

|

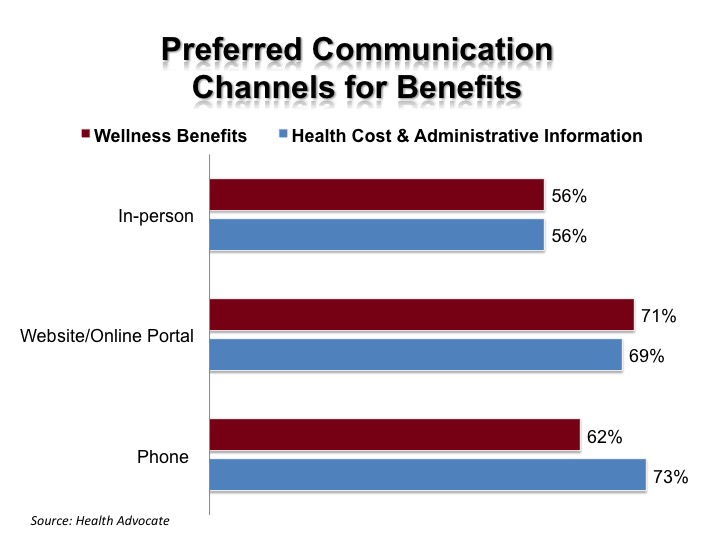

Preferred Communication Channels for Benefits

Communication is using different channels to reach each employee with your message. By applying several communication best practices for Open Enrollment, you can improve internal communications in the workplace. Let’s take a closer look.

Based on a 2017 study from Health Advocate, employees responded that they preferred to receive workplace benefits information with a person by phone, a website/online portal, and an in-person conversation. Additionally, employees expressed stronger preferences towards certain communication methods based on the topic area. Interestingly, despite knowing how they prefer to receive this information, employees reported that they did not receive it often enough from their employers. Over 40% felt their employer under-communicated information in these (and other) areas.

Interestingly, despite knowing how they prefer to receive this information, employees reported that they did not receive it often enough from their employers. Over 40% felt their employer under-communicated information in these (and other) areas.

How can I leverage these communication channels with my pre-tax benefits?

The key is to integrate multiple communication channels and create multiple touch points with employees. For example, you might introduce your pre-tax benefits by sending employees an email inviting them to the online portal. Once at the online portal, consider providing calculation tools to allow employees to interact and estimate their own savings. You can also challenge employees to answer questions regarding their pre-tax benefits. Getting employees to interact helps you confirm that your message is not only sent, but being received. You might then follow up with an invitation to review/discuss their pre-tax benefits by phone or in person.

Holding a Meeting ≠ Communication

Apart from the three methods above, you can also go with the “Let’s hold a meeting” route. Just remember, holding a meeting does not equate to communication. If you choose the meeting option, Smart Business recommends the following: strong visuals, interactive options (hand-raising does not have to wait until the end) and bursts of information (think sprint, not marathon).

How can I apply this to my pre-tax benefits?

The first step is to make your meeting or presentation an interactive and relatable Open Enrollment guide. A few ideas include:

- Incorporate polling questions. Who has out-of-pocket expenses for Medical, Dependent Care and Transportation? Who would like a 30% raise? These questions aim to engage employees in the discussion.

- Create scenarios that employees can identify with. When employees understand the personal benefits they can gain, they are more likely to enroll.

- Require audience participation through a fun game or roll playing. For example, give two employees $1,000 in Monopoly money. Assume they both have the same expenses but one has a pre-tax benefit accounts.

Following the presentation with emails (or phone calls) will keep the information front-of-mind, days and weeks after the presentation has passed. Your employees will thank you for it. (At least, we hope they will.) If you’re re-evaluting your pre-tax benefits, learn about the main questions to ask here.

What Now?

Opt for a variety pack when it comes to communication best practices for Open Enrollment and you’ll increase your chances of reaching the variety of people in your workforce. Where there’s a will, there’s a way… Good luck!