15 Eligible Medical Expenses Under $15

The end of 2020 is (finally) almost here. That means it’s time to start planning how you’re going to use up those extra FSA funds. To avoid losing any of that pre-tax money to the use-it-or-lose-it rule, it’s important to plan your spending down to the last dollar. To help, we’ve put together a list […]

Winter skincare items to splurge on

Save twice when you shop for these eligible winter skin care items leading up to Black Friday. While IRS guidelines aren’t designed to support beauty, they are designed to support health, which includes taking care of your skin! Winter skincare & your FSA Purely cosmetic products (e.g. mascara, teeth whitinening kits, foundation) are not considered […]

Making masks and PPE items eligible expenses

EDIT: In March 2021, the IRS released Announcement 2021-7, establishing that “personal protective equipment, such as masks, hand sanitizer and sanitizing wipes, for the primary purpose of preventing the spread of the Coronavirus Disease 2019 (COVID-19 PPE) are treated as amounts paid for medical care under § 213(d) of the Internal Revenue Code (Code).” What […]

4 Strategies to Strengthen Your Benefits Programs

The job market can be a blessing or a curse for human resource professionals. With low unemployment rates comes a highly competitive job market where every bell and whistle can be the determining factor to be the employer of choice. Inc.com gives us 7 Ways to Improve Employee Satisfaction, which can certainly improve the employee […]

3 Strategies to Maximize Your Open Enrollment

You can never be too ready for Open Enrollment, so we wanted to share three strategies on how to make the most of your virtual Open Enrollment. In case you missed it, make sure you check out our pieces on how to improve your Open Enrollment readiness levels and what other clients are sharing about […]

Top 5 Health Care Trends for 2021

Peak open enrollment season is just around the corner. So, like many employers, we too are wondering what this year will bring in the way of health care trends. Some find themselves wondering, what will be the key health care trends this year? As the saying goes, “If there’s one thing we can count on, […]

Improving your Open Enrollment readiness level

What is your Open Enrollment readiness? For optimists out there, this suggests employers are just over the hump and will be soon finalizing their plans for open enrollment. However, it also means employers have 45% of the work remaining. If you are like most employers, you still have a number of preparations to make prior […]

Easy investments that can save you time and money

Let’s be honest for a moment…we all have good-ish intentions when it comes to saving, and (more importantly) investing our hard-earned money. If you really think about it, you’ve been pretty smart lately setting up price-alerts for that fancy patio set that you’ve always wanted. Or, you’ve been trolling sites like Walmart, Costco and Amazon […]

If pre-tax health accounts were types of ice cream

Given that the final days of summer are coming to a close, we thought it fitting to treat our readers to a more flavorful post. Below, we explore some surprising (yet tasteful) similarities between types of ice cream and pre-tax accounts. Your company: The ice cream parlor For starters, the ice cream parlor you’re ordering […]

Predictions on the future of virtual health care

Where are we now? Our current healthcare system is largely still a brick and mortar, in-person setup… where people who are sick go to be seen, and treated by medically trained individuals. Current trends are now pointing to virtual health care. What changes are coming to virtual health care? Virtual health care is now is […]

7 legislative changes affecting benefits since COVID-19 started

When we started out 2020, any legislative predictions we had for the year would have been wrong. It was an election year after all, which typically creates strong stalemate positions and not much else. But as we all know, 2020 has been anything but typical. In fact, we have seen over 7 significant legislative changes […]

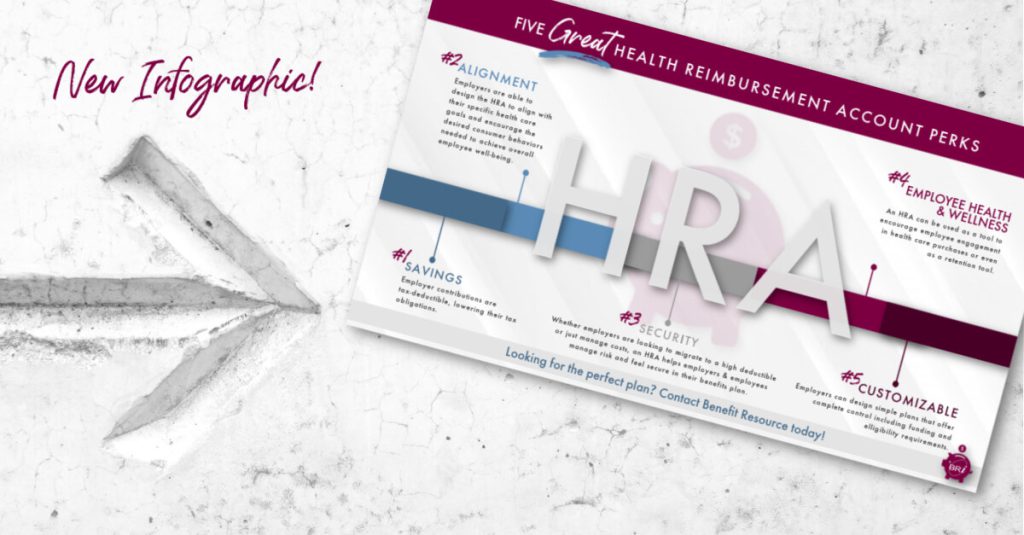

Five great Health Reimbursement Account perks

Want the scoop on Health Reimbursement Account perks? Click here to download our infographic and see why it’s the perfect plan to take advantage of. For the best viewing experience: Use your keyboard controls or mouse to zoom in on the image. Other Resources Blogs: Read some of our Health Reimbursement blogs like: I have an HRA. […]

3 memes to describe how HR managers are feeling right now

The worldwide situation with the coronavirus has been stressful, to say the least. We’ve heard it said that laughter is the best medicine. That’s why we compiled these memes to describe how HR and benefits professionals might be feeling right now. Up first: How many is too many? #askingforafriend Chances are you’re working on updates […]

HSA investments allow participants to invest in themselves

When talking about saving money for the future, the first thing that tends to come to mind is retirement accounts like a 401(k) or IRA. In addition to a general retirement account, consider a Health Savings Account (HSA). Making HSA investments enables you to grow this tax advantaged account at a greater rate long-term, while […]

A new way to save on feminine care products

Thanks to a recent wave of legislation that passed back in March, all products for “that time of the month” can now be purchased at a 25 to 40 percent discount. This change takes place exactly 100 years after the historical 19th Amendment was ratified, allowing women the right to vote. All you need to […]

Father’s Day 2021: Best Picks

This Father’s Day 2021, you might be surprised at some of the items you can find online. Make sure you let your dad (or uncle or brother!) know about these steals that they can find to treat themselves this Father’s Day (and all at a discount*). Our best picks for Father’s Day 2021 The Basics […]

Your BRI notifications cheat sheet

It’s important to keep track of what’s happening with your accounts– that’s why we created BRI notifications. You Pick and Choose We’ve been perfecting our notification system since 2013, so you can trust its reliability. It even made it onto our list of the Top 25 Ways to Save with Pre-tax Benefits. How it works: […]

Specialty Accounts For All

Whether your employees are paying for student loans, groceries, utilities, or gym memberships – life adds up, and quickly. $ + $ + $ = $$$. (Literally.) During this pandemic, money’s producing almost as much anxiety and panic as the coronavirus itself. Unfortunately, COVID-19 is quickly interrupting the lives of people all over the globe […]

10 new eligible items you can buy with your pre-tax dollars

The CARES Act introduced new eligible items that you can purchase with funds from your pre-tax benefits accounts (FSAs, HSAs, and HRAs). Effective January 2020, menstrual care products are now considered eligible expenses. Over-the-counter drugs and medicines are also now eligible for purchase without a prescription. Since the funds in these accounts are deducted from […]

Manage your pre-tax accounts wisely – here’s how

As the COVID-19 pandemic continues and unemployment rates rise, you’re probably looking to maximize every dollar that you currently have. Fortunately, you can do so through smart use of your pre-tax accounts. Step 1: Review your elections The first step is just reviewing your current elections. For the following account types, this might mean making […]

Treat allergy symptoms using pre-tax funds

Spring is in the air. This means that common seasonal allergy triggers like pollen is too. Fortunately, you can combat these allergy symptoms using funds from your HSA, FSA or HRA. We’ll tell you how shortly. First, we’ll cover how to tell if your symptoms likely indicate allergies or another ailment. This will help ensure […]

Do you need to make benefit changes because of COVID-19?

COVID-19 has caused upheaval in many ways. This includes employees’ work benefits, particularly pre-tax accounts. For employees with an HSA, Dependent Care FSA, and/or commuter plan, there may be the opportunity to make changes to their accounts. Here are the main updates employees should know about. UPDATE: See our blogs IRS releases new relief affecting […]

What you need to know about the CARES Act

The new CARES Act, formally named ‘‘Coronavirus Aid, Relief, and Economic Security Act’’, brings a variety of actions aimed to aid in the fight of COVID-19, along with spurring economic stability and growth. You can view the full list of inclusions in this Forbes article. Here, we will focus on the three possible changes affecting […]

New tax filing deadline announced by the IRS

Tax time is no longer just April 15th. Recent guidance from the IRS delays the Federal tax filing deadline and Federal tax payment deadline. However, state deadlines and the impact on contributions to a Health Savings Account remain less clear. What are the details? The deadline was extended from April 15, 2020 to July 15, […]