The new CARES Act, formally named ‘‘Coronavirus Aid, Relief, and Economic Security Act’’, brings a variety of actions aimed to aid in the fight of COVID-19, along with spurring economic stability and growth. You can view the full list of inclusions in this Forbes article. Here, we will focus on the three possible changes affecting tax-free account holders.

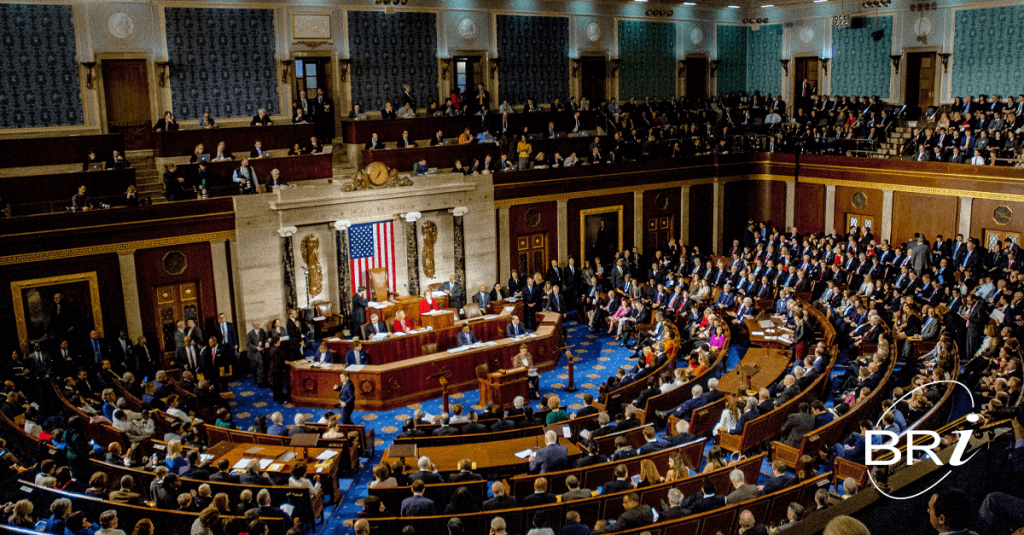

Where does the CARES Act stand?

The Senate approved the CARES Act late on Wednesday, March 25. It was then voted and approved by the House on Friday, March 27. Within hours, it was signed into law by the President.

What can we expect for tax-free accounts?

There were three direct inclusions that affect HSAs, FSAs and HRAs. First, let’s start with HSAs and telehealth services.

HSAs paying for telehealth

In general, Telehealth services are already considered an eligible expense for use with an Health Savings Account (HSA). However, these expenses cannot be covered until an individual meets a minimum deductible.

Under the CARES Act, plans (or plan sponsors) may pay for telehealth services before reaching the deductible, without impacting an individual’s eligibility for an HSA. However, this is a temporary provision to encourage telehealth services during the current healthcare emergency. The bill outlines an end date of December 31, 2021 for this provision.

OTC products as eligible items

After the Affordable Care Act, over-the-counter (OTC) drugs and medicines required a prescription in order to be eligible for reimbursement from an HSA, FSA or HRA. The CARES Act would allow individuals enrolled in these pre-tax accounts to pay for OTC drugs and medicines without a prescription. This action helps to reduce additional strain from an already overwhelmed healthcare system. This is a permanent change.

Feminine care products as eligible items

Finally, menstrual care products were added as an eligible expense for use with an HSA, FSA or HRA. Menstrual care products are defined as tampon, pad, liner, cup, sponge, or similar product used by individuals with respect to menstruation. This move puts these health products in line with other already eligible expenses.