Health Savings Accounts (HSAs) are 14 years old this year. In some respects, 14 years seems like a pretty long time. But, if we consider a 14 year old child is a mere adolescent, we could also consider HSAs are still in their formative years with a lot of growth still on the horizon. In fact, here are 6 things that might surprise you about an HSA.

1) HSAs are not a use-it-or-lose-it benefit.

HSAs belong to the participant and are not lost. This means if you don’t use the funds during this year, they automatically rollover to the next year. Additionally, if you change employers, you get to take the funds with you. From October 10, 2017 through December 31, 2017, Benefit Resource issued the BRight Ideas Quiz to existing participants and eligible employees. Over 8,700 individuals completed the quiz to assess their familiarity with pre-tax accounts. Nearly 30% of all respondents, incorrectly cited “HSA funds are lost if I do not use them”. Individuals that reported having an HSA fared a little better with only 18% viewing them as a use-it-or-lose it benefits.

HSAs belong to the participant and are not lost. This means if you don’t use the funds during this year, they automatically rollover to the next year. Additionally, if you change employers, you get to take the funds with you. From October 10, 2017 through December 31, 2017, Benefit Resource issued the BRight Ideas Quiz to existing participants and eligible employees. Over 8,700 individuals completed the quiz to assess their familiarity with pre-tax accounts. Nearly 30% of all respondents, incorrectly cited “HSA funds are lost if I do not use them”. Individuals that reported having an HSA fared a little better with only 18% viewing them as a use-it-or-lose it benefits.

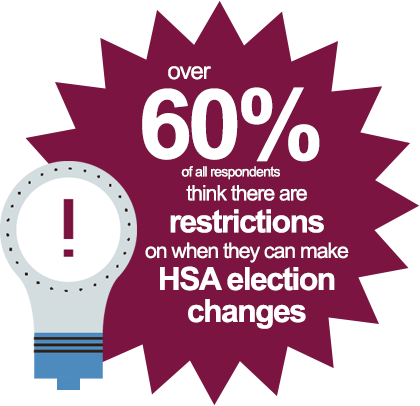

2) HSA elections and changes can occur at any time.

HSA elections can be made and changed at any time during the year. There is no requirement to have a life event (such as marriage, birth of a child, death in the family) to make a change. It could be as simple as you received a raise and decide to increase your contributions. Alternatively, money might be a little tight and you want to cut back on contributions. Your employer, however, may restrict changes to once per month for administrative purposes. Over 60% of all respondents (and 53% of HSA participants) incorrectly assume there are restrictions on when HSA election changes can be made.

HSA elections can be made and changed at any time during the year. There is no requirement to have a life event (such as marriage, birth of a child, death in the family) to make a change. It could be as simple as you received a raise and decide to increase your contributions. Alternatively, money might be a little tight and you want to cut back on contributions. Your employer, however, may restrict changes to once per month for administrative purposes. Over 60% of all respondents (and 53% of HSA participants) incorrectly assume there are restrictions on when HSA election changes can be made.

3) HSAs do not require you to submit receipts (but you still need to keep them).

Unlike an FSA or HRA which are employer-owned accounts, HSAs are individually-owned by participants. This means the use of the account is ultimately between the individual and the IRS. The HSA participant is responsible for determining if an expense is eligible and for maintaining receipts to certify the expense. If ever audited by the IRS, you may be asked to submit your receipts for verification.

4) HSAs earn interest and/or can be invested.

HSAs are not only a tool to pay for medical expenses today, but for the future. As mentioned earlier in this post, HSA funds rollover from year to year. But what’s even better, HSAs earn interest or can be invested like a 401K or IRA. Coming off an epic year of 27% growth in investments, it isn’t hard to see the potential that exists to grow an HSA balance. The reality is, it is more than just the potential you need to be concerned with- it is a growing need. According to Fidelity, the average couple retiring will need $275,000 in health care expenses (excluding long-term care). You need to take advantage of all the tools you have if you want to thrive in retirement.

5) You can use your HSA funds even after you are no longer eligible to contribute.

Have you changed health plans, become eligible for Medicare or possibly changed employers? In most cases, any of these situation would mean an end to your pre-tax benefit account. But HSAs are a secret weapon you can take (and use) wherever life takes you. Even if you become ineligible to contribute to an HSA, you can continue to use any remaining HSA funds. As long as they are used for eligible medical expenses, they remain 100% tax-free.

6) HSAs are awesome!

HSAs sometimes seem like a well-kept secret. But, we encourage you to tell your neighbor, scream it from a mountain top or maybe Snapchat like a 14 year old. HSAs offer some unique advantages that are not available from just any benefit or tax-advantaged account. It is important to understand (and embrace) these unique features. And just maybe, next time you hear the word HSAs, you will no longer be surprised by any of these things.