If you have a Flexible Spending Account (FSA), you know that every year during Open Enrollment (OE), you choose how much to put aside in the account, otherwise known as your election. Recalling Stephen Covey’s second habit of highly effective people – begin with the end in mind® – you can base your election off of estimated expenses for the upcoming year.

While one of your goals may be to estimate your FSA election for the upcoming year, you have another (equally important) goal: estimate your savings. Let’s be honest– one of the main reasons you enrolled in a pre-tax account was to save money.

Let’s explore these two goals and how to achieve them, starting with…

Begin with the End in Mind®

It Stephen Covey’s book The 7 Habits of Highly Effective People Habit 2 is begin with the end in mind®. People with this habit are described on the Franklin Covey website as individuals who: “Develop an outcome-oriented mindset in every activity they engage in—projects, meetings, presentations, contributions, etc.”

Applying this approach to your FSA election, your FSA should achieve a dual outcome. It should help cover your expenses after insurance across medical, vision and dental. It should also provide savings of roughly 30 cents to the dollar*, depending on your tax rate.

Getting Started

Estimating Expenses

You can estimate your expenses in a few ways.

One way is to use the free online calculator from the Benefit Resource Education site. Before visiting the site, you’ll want to have several pieces of insurance information. This helps to determine an accurate estimate. Information you will need:

- Copays for any prescriptions or annual doctor’s visits

- Annual deductible

- Estimates or past over the counter costs

- Projected dental costs after insurance

- Annual vision costs after insurance

- Other specialty medical costs after insurance

Once these values have been provided, a number will automatically generate in the “Suggested Plan Year Election” box.

Beginner Tip: If you aren’t sure what any of those numbers are, you can use one of these alternative options.

Option 1—Use an FSA Rollover to your advantage

If you know your employer offers an FSA Rollover, you can put up to $500 in the FSA with no risk. This makes estimating easier. Let’s say you don’t have many known medical expenses. But, you have glasses and will need a replacement pair this year. You know your glasses typically cost $200. You can safely make an election for $700 and be confident you will not lose funds.

Just confirm your employer offers the FSA Rollover and not an Extended Grace Period or regular forfeiture before committing to an election amount. (See Part B of our blog FSA Eligible Purchases for the End of the Year).

Option 2—Use your deductible and past experience as a benchmark

Do you meet your deductible every year? Do you have certain expenses which are known? These are good indicators of what you should estimate in the coming year. First, find out what your deductible is. Then, set your FSA election to that amount. This approach helps you plan for the most expensive items. But, you may need to pay out-of-pocket for unexpected expenses.

Option 3—Write it out

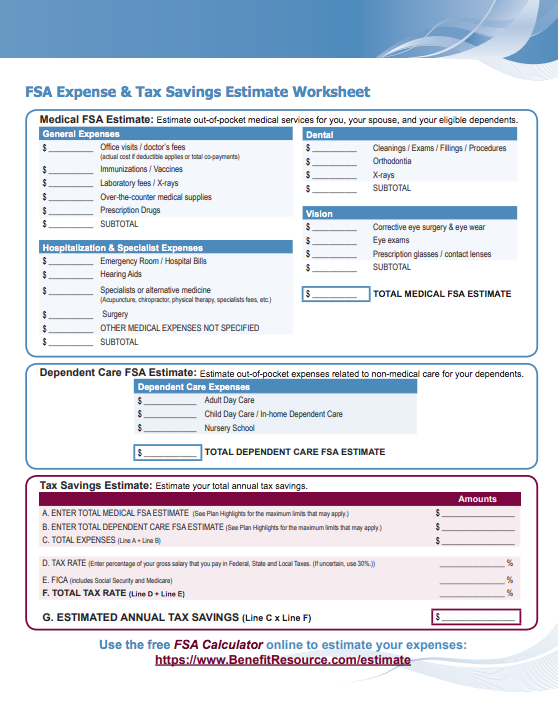

Finally, if you prefer a pen and paper over entering information electronically, you can print the FSA Election Estimate Sheet. This document provides a slightly more in-depth look at potential expenses. It includes general medical expenses, hospitalization and specialist expenses, and dental and vision. Download and print the PDF here.

Estimating Tax Savings

If you’re on the online calculator page, you’ll notice there is a section that estimates your tax savings. Once you’ve provided the information for your FSA election estimate, you can calculate your savings by providing your tax rate.

Most of us might not know our tax rate off the top of our head. If you need a ballpark figure, we’d advise listing a percentage between 30 and 40.

Once again, you can also use the FSA Election Estimate Sheet to estimate your savings.

Putting It All Together

An example of estimated expenses and tax savings is provided below. The profile below is for a 25 year old female who is moderately active and has no prescriptions.

| Medical Expenses: | $170 ($20 for two annual visits and $150 for three specialist visits) |

| Dental Expenses: | $120 ($90 for a cavity and $20 for an x-ray) |

| Vision Expenses: | $70 ($20 for two annual eye exams and $50 for contact lenses) |

| Insurance Deductible: | $2,000 |

| TOTAL ESTIMATED EXPENSES: | $2,360 |

Unless you are certain of your expenses, it is a good best practice to set your FSA election a little lower than your estimate. In this case, the individual could set aside $2,300 for her FSA election. Let’s assume the same individual has a tax rate of 30 percent and is subject to 7.65% in FICA. She will pay a total of 37.65% in taxes. Ouch. But because of her tax-free FSA election…

She saves $866.

Your Turn

Some people might have records of previous expenses and the associated costs. If that’s you, dig into the archives to calculate your FSA election. Others might not have the information readily accessible. No fear. If that’s the case, do your best to think back to what you’ve spent on just medical, dental and vision expenses in the past and write down modest estimates. Better to underestimate than overestimate in this case.

Regardless of which scenario you find yourself in, you can still begin with the end in mind® as you prepare for Open Enrollment.

All set with your FSA election? Check out: Top Searched Open Enrollment FAQs.

*According to https://www.pgpf.org/budget-basics/who-pays-taxes, the effective average tax rate is 31.9%