As kids, there were fun games that helped us make choices… In benefits, we are often presented with a 50 page document and told “Here you go. Choose. By the way, Open Enrollment closes on Friday. Time is of the essence.” Too bad making your pre-tax benefit account decisions is not as easy as pointing and saying “Eenie meenie miney mo – Which account should I choose?”

But maybe it can be.

What if you could choose the right pre-tax benefit accounts by answering four questions?

Start with the Questions

- What is the account? This is a one to two sentence description that defines the account.

- What is it used for? This clearly outlines what the account is (and isn’t) used for.

- How do I save? This provides an illustration of how tax advantaged accounts save you money.

- Why do I need this account? This brings it all together and illustrates the unique advantages of the account.

What accounts are available?

The specific account options you have will vary based on plans offered by your employer. Several of the most common accounts are listed here. Please be sure to download the cheat sheets for answers to all four questions.

Medical FSA

Medical FSA

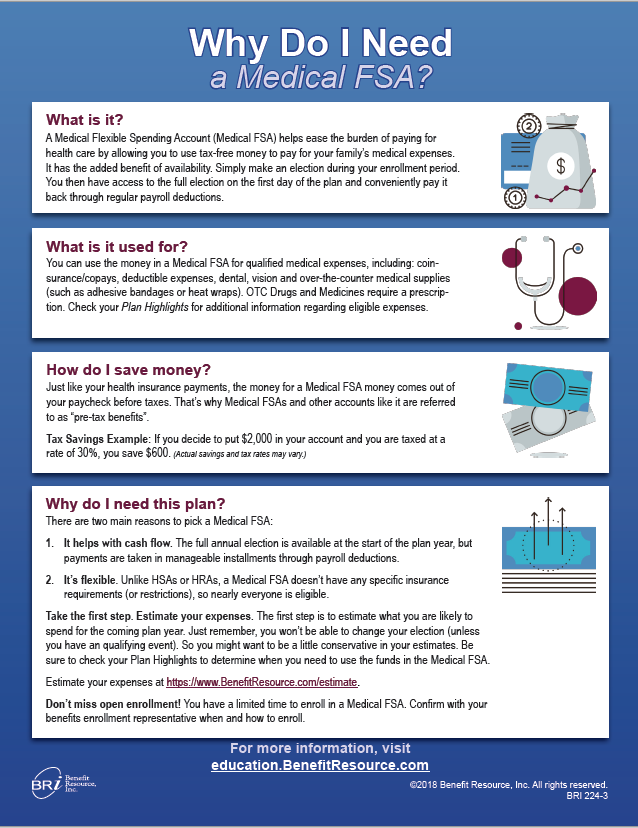

A Medical Flexible Spending Account (Medical FSA) allows you to use tax-free money to pay for your family’s medical expenses. Simply make an election during your enrollment period.

You then have access to the full election on the first day of the plan and conveniently pay it back through regular payroll deductions. There are no specific health insurance requirements to have a Medical FSA.

Download: Why Do I Need a Medical FSA?

Limited FSA

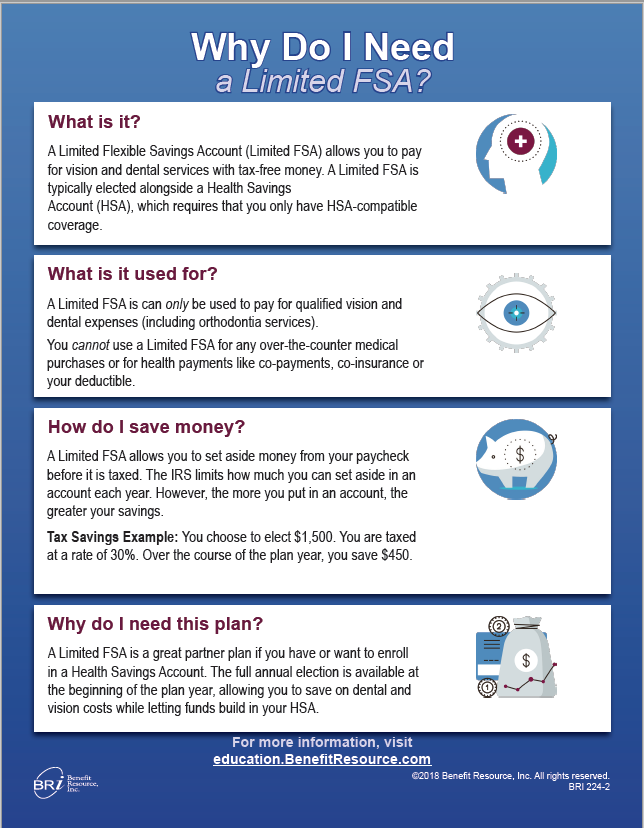

A Limited Flexible Savings Account (Limited FSA) allows you to pay for vision and dental services with tax-free money you set aside.

A Limited FSA is typically elected alongside a Health Savings Account (HSA). Your full Limited FSA election is available on the first day of the plan year.

Download: Why do I Need a Limited FSA?

Dependent Care FSA

A Dependent Care Flexible Spending Account (Dependent Care FSA) allows you to use tax-free dollars to pay for qualified child daycare or adult day care expenses.

A Dependent Care FSA is a separate election from a Medical FSA or Limited FSA. You cannot use a Dependent Care FSA for medical expenses.

Download: Why do I Need a Dependent Care FSA?

Health Savings Account

In simple terms, a Health Savings Account (HSA) is like a piggy bank for medical expenses that builds over time. You can choose to use it now or save it for the future. You own the account.

An HSA also has the added benefit of earning interest (or being invested), all tax-free. If you want to enroll in an HSA, you also need to enroll in an HSA-compatible health plan.

Download: Why do I Need an HSA?

Health Reimbursement Account

A health reimbursement account can be a little difficult to explain without understanding the specific rules that your plan uses. In general, an HRA is an employer-funded account that individuals can use to pay for specific eligible medical expenses.

An HRA must generally be offered with a integrated group health plan. To get a better understanding of your specific options, be sure to ask your benefits representative for a copy of the plan documents.

You might also check out 5 Surprising Facts about an HRA.

Mass Transit Account

Mass Transit Account

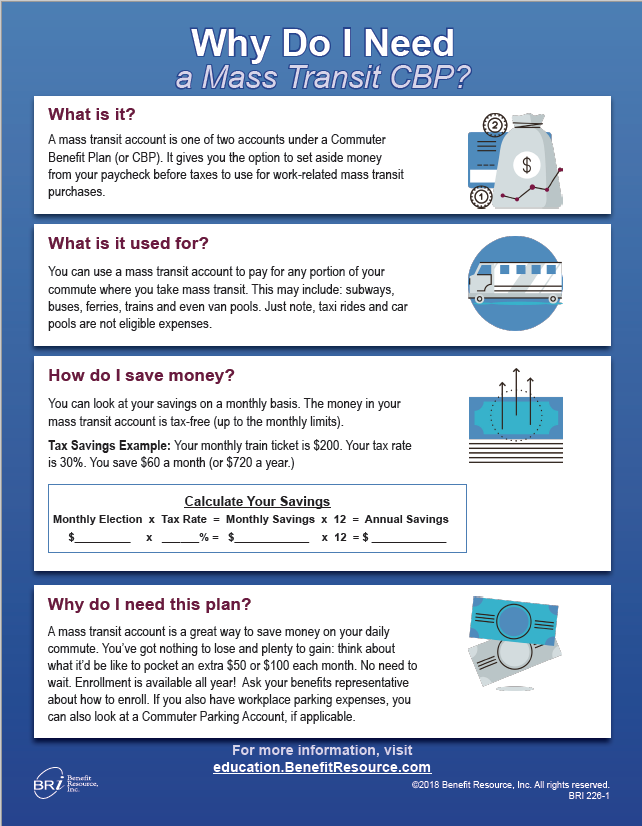

A mass transit account is one of two accounts under a Commuter Benefit Plan (or CBP). It gives you the option to set aside money from your paycheck before taxes to use for work-related mass transit purchases.

This may include: subways, buses, ferries, trains and even van pools. Just note, taxi rides and car pools are not eligible expenses.

Download: Why do I Need a Mass Transit Account?

Parking Account

A parking account gives you the option to set aside money from your paycheck before taxes and use it for work-related parking expenses.

This may include parking at/near your place of employment or parking at/near a location in which you take mass transit.

Download: Why do I Need a Parking Account?

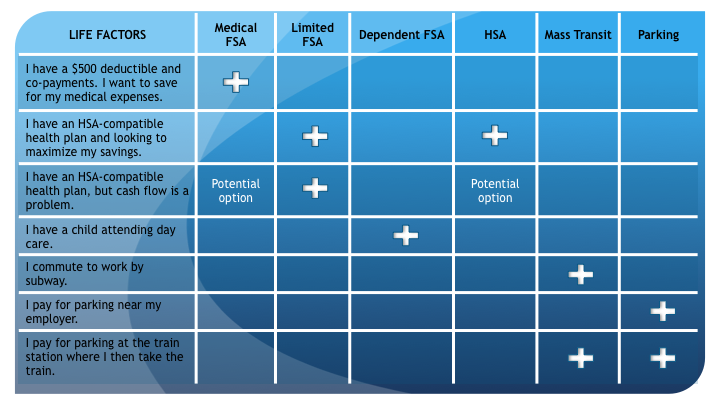

So, what should I enroll in?

While your specific scenario is likely to vary, you can easily look at key life factors to determine what accounts you should consider. Please check with your employer to confirm if a specific plan if available.

Once you assess key life factors and answer “Which account should I choose?” the only choice left to determine is “How much should I set aside in a tax-free account?”

Calculate your savings today to prepare for your Open Enrollment period.

Medical FSA

Medical FSA

Mass Transit Account

Mass Transit Account