Do you have a Health Reimbursement Account? (Also referred to as a Health Reimbursement Arrangement or HRA). If so, you may have asked yourself “How do HRAs work?”

Do you have a Health Reimbursement Account? (Also referred to as a Health Reimbursement Arrangement or HRA). If so, you may have asked yourself “How do HRAs work?”

As out-of-pocket expenses rise for employees, an HRA provides a great opportunity for employers to cushion the increase. According to the 2017 Employer Health Benefits Survey released by Kaiser Family Foundation, over 81% of covered workers now have a deductible, up from 74% in 2012. Of those individuals, 51% have a deductible of $1,000 or greater for single coverage, up from just 34% in 2012. More employer-sponsored health plans are choosing to include an HRA and the trend is only growing.

So, what is an HRA? And how do HRAs work? Let’s take a closer look at the pros and cons.

1. An HRA is SOLELY employer-funded.

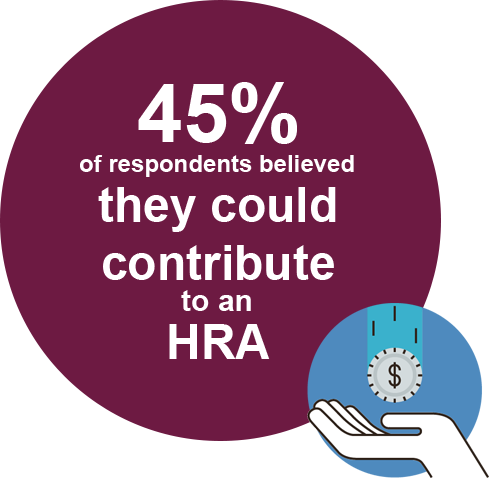

While FSAs and HSAs allow employees to contribute pre-tax dollars through payroll, an HRA is solely funded by the employer (or plan sponsor). This is a fundamental component of HRA rules. However, based on Benefit Resource’s 2017 BRight Ideas Quiz, 45% of all respondents (meaning those with or without an HRA) incorrectly believed they could contribute to an HRA. Respondents who indicated they were currently enrolled in an HRA fared a little better at 34%. This suggests there continues to be a gap in what employees understand about these benefits.

2. HRAs generally need to be integrated (at least for now)

An HRA must typically be offered alongside a comprehensive health plan. This is what is referred to as an “Integrated HRA”. But, why is an “Integrated HRA” necessary? An HRA is currently defined as a group health plan. The Affordable Care Act (commonly referred to as Health Care Reform) placed certain restrictions on group health plans. Specifically, benefits paid out of group health plans cannot have annual limits. When an HRA is integrated, the underlying health plan solves the requirement regarding annual limits. However, a stand-alone HRA with a specific contribution amount is viewed as being in violation of the annual limit rule. There are exceptions allowed for Limited HRAs, which can be offered without a comprehensive health plan.

The current administration has expressed a strong desire to review these rules to see if additional exceptions or interpretations would allow for stand-alone HRAs to be offered.

3. An HRA may not automatically cover your dependents

An HRA can be designed to cover just an employee or an employee and their dependents. Every HRA plan will have Plan Documents that define its specific HRA rules. If dependents are to be covered by an employee’s HRA, they must also be enrolled in a group health plan. From a practical perspective, it means dependents must be identified on claims and they, too, must be eligible.

4. The expenses covered by an HRA can vary

IRS Publication 502 defines eligible medical and dental expense for IRS purposes. While Publication 502 can often be used as a guide to determine if an expense is likely eligible under an HRA, it will not always be the determining authority. Employers have the ability to place additional restrictions on what is considered an eligible expense for HRA reimbursement purposes. HRA participants should always refer to their plan documentation for additional guidance on what expenses are covered. Participants with Benefit Resource can find details regarding their employer’s plan be accessing their Plan Highlights through the secure BRiWeb Login.

5. Employers set many of the rules for HRAs

If you haven’t gathered by now, HRAs are not always black and white. HRA rules can be complicated. And, there are pros and cons to HRAs. The employer plan sponsor ultimately determines how to handle certain aspects of the HRA. Unfortunately, less than 50% of respondents to the BRight Ideas Quiz correctly indicated “My employer / plan sponsor sets many of the rules regarding what expenses are eligible, when benefits are paid and when claims must be submitted.” The most common factors determined by the employer, include:

- How much will be allocated to employees and what causes the amount to vary

- What categories of expenses are eligible for reimbursement

- What happens to funds at the end of the plan year when an employee is no longer eligible, is terminated and/or retires

- When claims need to be incurred and submitted for reimbursement

Looking for more information on how HRAs work? Check out HRA Basics. Just remember, the specific HRA rules for each plan are outlined in the plan’s documentation. If Benefit Resource is administering your plan, you can find a quick reference in the Plan Highlights. These can be found in the document section of the secure BRiWeb.

Sources:

- Benefit Resource’s 2017 BRight Ideas Quiz ran from October 10, 2017 through December 31, 2017.

- 2017 Employer Health Benefit Survey: https://www.kff.org/report-section/ehbs-2017-summary-of-findings/