As open enrollment nears for many and benefits options are presented, it is important to have a clear understanding of how each plan works and why you might want to enroll. To make sure you have your ducks in a row this open enrollment, we compiled the Top Searched Open Enrollment FAQs.

The results?…Participants (and prospective participants) struggle with three main areas when considering open enrollment FAQs:

- Dependent Care FSAs

- Using Funds Appropriately: Whom and What Funds Can be Used For

- Important Dates and Deadlines

Our goal is to answer these Top Searched Open Enrollment FAQs to help ensure all your ducks are in a row as you head into a new plan year. It may not be easy, but it doesn’t have to be hard. Let’s take a closer look.

A. Nuances of a Dependent Care FSA

A. Nuances of a Dependent Care FSA

A Dependent Care FSA is a routine cause for confusion. Many participants are unclear of the differences between a Dependent Care FSA and a Medical FSA. According to initial responses from the 2017 BRight Ideas Prize Contest, nearly 40% of respondents incorrectly assume you can make one election for both dependent care and health care expenses.

What is a Dependent Care Flexible Spending Account (FSA)?

First, think daycare expenses, not health care! The most common misconception is that a “Dependent Care FSA” is used for a dependent’s health care expenses. This is not true. With a Dependent Care FSA, you elect to have funds taken from your paycheck before taxes to pay for eligible Dependent Care expenses (e.g. daycare). Next, confirm you have an eligible dependent. The care must be incurred for eligible dependents, typically children under the age of 13 or adult dependents incapable of self-care. If you intend to pay for your dependent’s health care expenses, this would be included in a Medical FSA election. If you intend to pay for both child care and health care expenses, you will need to make two separate elections.

What services are eligible under a Dependent Care FSA?

There are a broad range of eligible services under a Dependent Care FSA, including:

- a day care that provides physical care services

- in-home care that provides physical care services

- a nursery school that provides physical care services

Ineligible services include:

- Services for education and meals

- Services provided by your minor child or dependent (e.g. older child)

- Overnight camps and lessons in lieu of day care

Please note: If you are separated or divorced, see IRS Publication 503 for special regulations on eligible services for qualified persons.

If I have a Dependent Care FSA am I still HSA eligible?

Yes. If you have a Dependent Care FSA, there is no impact on your eligibility for an HSA. You are free to have both at the same time with zero consequence or conflict of benefits.

Will Dependent Care funds be allowed to roll over into subsequent plan years?

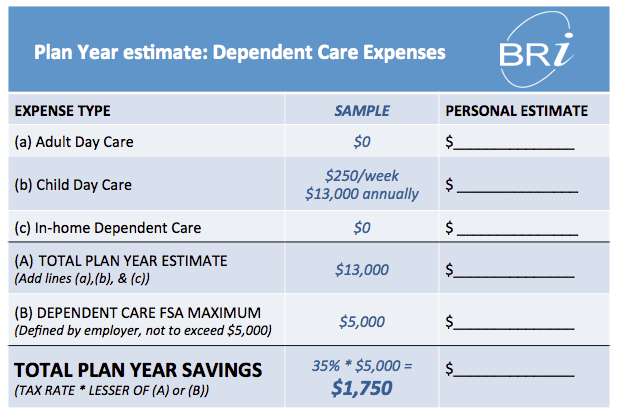

No. There is no rollover option for Dependent Care funds. This is only available for a Medical FSA if permitted by your employer. We advise you make your election based on what you’ll need for the year. Use the chart below or the Dependent Care FSA Worksheet to estimate your expenses.

That wraps up the Dependent Care FSA FAQs. However, we know there is more to Dependent Care, so feel free to visit our FAQs page to learn more. Let’s move on to using your funds…

![]()

B. Using Funds Appropriately

When individuals first enroll in a pre-tax benefit account, they are often looking to understand what expenses will be eligible under their plans and what other factors may affect their ability to use funds. If you are enrolling in benefits through Benefit Resource, you can find the specific rules for your plans in the Plan Highlights, found through the Secure Participant Login. Although specific rules may be defined by your employer, here are some general guidelines to follow.

If I am enrolled in single coverage under an HSA-compatible health plan, can HSA funds be used for my spouse or eligible dependent that are not under my health plan?

Yes. HSA funds may be used for a spouse or any eligible dependent on your tax return, regardless of their coverage status. Just make sure the expense was not already reimbursed by another source. While these expenses may be reimbursed for the HSA, just remember your HSA Contribution Limit is based on your coverage type (single vs. family).

Can the funds in my Medical FSA be used for my spouse’s and/or dependent’s eligible expenses?

Yes. Funds in your Medical FSA can be used for your spouse’s eligible expenses and your dependent’s eligible expenses.

Figuring out how to use your funds isn’t always straightforward, but we hope you had some questions cleared up. Ready to tackle important dates and deadlines?

C. Dates and Deadlines

When you evaluate your benefits each year, it is important to have a clear understanding of the dates and deadlines related to your plans. Benefit Resource outlines several key dates and deadlines in your Plan Highlights available from the Secure Participant Login. In addition to the specific dates outlined by your plan, there are several general factors to consider.

Do I need a new Beniversal card each plan year?

No. The Beniversal Card is good through its expiration date, unless you are otherwise notified. The card is dynamically updated with any new benefits or elections you may have, or as funds become available. For example, if you had a Commuter Benefit in 2017 and then you added a Medical FSA in 2018, both your Commuter Benefit funds and your new Medical FSA funds would be housed on the same card. Always keep your receipts or know what to do if you lost your receipts.

I am moving from a Medical FSA this plan year to an a HSA next plan year. Are there any issues or concerns that I should be aware of?

The most important thing is to make sure you know when you become HSA eligible. Here are a few steps to help you accomplish that:

- Determine when your Medical FSA coverage ends

- Determine if you have overlapping coverage (and how you can avoid it)

If you have overlapping coverage, you may be eligible for one of two exceptions: an Extended Grace Period or a Medical FSA balance at the end of the plan year.

For more information, click here.

How much can I set aside in a parking or mass transit account on a tax-free basis each month?

Open enrollment is a good time to review your current election or decide if you want to open a parking or transit account. Each year, the IRS sets monthly limits for parking and transit accounts. The 2018 limits were announced in October. The current maximum pre-tax election for parking and transit accounts (effective until December 31, 2017) is $255 per month. The limit will increase to $260 per month on January 1, 2018. If you are already making an after-tax election to cover your full parking expense, Benefit Resource will automatically adjust your election to reflect the new monthly pre-tax maximum. If you increase your election, please allow two to four weeks (one to two payroll cycles) for it to take effect. Remember, when you sign up for a commuter benefit, you will need to make separate elections for parking and transit. You cannot transfer funds between accounts.

Still Have Questions?

We know Open Enrollment FAQs can be difficult to navigate. That’s why we’re here- to be a resource and help you make the right choice for your next plan year. Check out all of the FAQs or submit a new one.

Also, feel free to contact us using any of the methods below:

Phone: (800) 473-9595, Monday – Friday, 8am – 8pm (Eastern Time)

Email: participantservices@BenefitResource.com

Online Live Chat: Monday – Friday (available with participant login access)

Para asistencia en Español, puede comunicarse al (800) 473-9595, lunes – viernes, 8am – 8pm (hora del Este) o via correo electronico a participantservices@BenefitResource.com.

*If the services are provided by a day care facility that cares for six or more individuals at the same time, the facility must comply with state day care regulations.