You enrolled in a Flexible Spending Account (FSA) and made your election for the year. A month into the plan year, you have an eligible dental expense and use your benefits card to pay it. A week passes and you receive a request for documentation of the expense. You quickly pull out the BRiMobile app, snap a picture of your credit card receipt and submit it for review. Your documentation is reviewed and you receive a second notice indicating your expense was not cleared. Frustration builds… “What could I have done differently? Why don’t they think my expense is eligible? I know it is.”

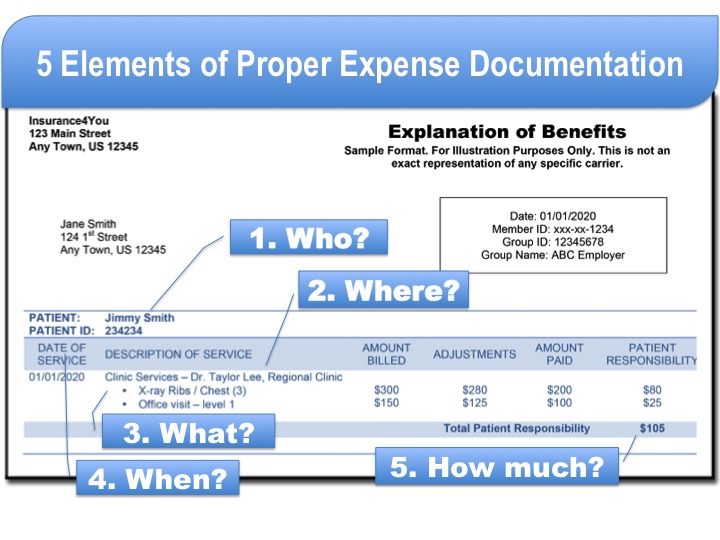

The reality is that a standard credit card receipt rarely contains the clarifying information needed to verify the eligibility of the expense. When submitting a receipt or documentation of an expense, it is important that it contains the required information to show it was eligible. Think back to your early education. As long as you have answered the 4W’s and an H (e.g. Who, Where, What, When and How Much), you are all set.

Five basic questions about Receipt Acceptance

- Who is the expense for? The receipt should indicate who received the eligible service/item.

- Where was the service provided? This is used to confirm that services were provided through a licensed practitioner or facility.

- What service/item was provided? This indicates what services or items are being provided. This is reviewed against IRS eligibility information to ensure the service is eligible. With certain expenses, you may be asked to provide a letter of medical necessity to confirm its eligibility.

- When did the service take place? The date of service is used to determine what plan year the expense may apply against. Your employer determines the specific dates that the services must be provided and the cut-off for submitting expense for reimbursement.

- How much is the service/item? This is the amount you were responsible for. In some cases, this amount may vary from the amount that was used on your benefits card.

So you might be thinking “That’s nice, but where do I find all of this information?” It is actually a lot easier to obtain than it might seem at first glance.

OPTION 1: ITEMIZED BILL. You will commonly receive an itemized bill from the health care provider where the service occurred.

OPTION 2: AN EXPLANATION OF BENEFITS (EOB). If the expense was billed through your insurance company, they will also have an Explanation of Benefits (EOB) which provides this same level of detail.

Health care providers and insurance companies are required to provide these types of documents regarding the services/benefits you receive. If you did not receive or are not able to locate these documents, you are often able to pull a copy from your online account records with either the provider or insurance carrier. You may also request to have one sent to you. Just remember the 4W’s and an H.

Related Articles